- Buy a Home

- Refinance

-

Loan Options

-

Resources

- Find a Loan Officer

-

About Us

- Login

Purchasing a home is a big decision, but you can put your best foot forward by doing your research. Our guides, calculators, worksheets, and other resources will help you learn and prepare for the homebuying process so you can move forward with confidence.

We know that purchasing a home can seem intimidating. A little research and preparation can make the process go smoothly. This guide is written to help some shoppers with this next big step in in their lives. It will help answer many of the questions you may have in regards to finding the right Realtor, neighborhood, and home.

Are you ready to buy your next home? The mortgage process may look complicated, but it doesn’t have to be. This guide was written to help homebuyers learn about financing their home. This guide contains the do’s and don’ts of home buying, the breakdown of your mortgage payment, what to expect at the closing table, and more.

Use our calculator below to find an estimated monthly mortgage payment that works for you. Please remember the dollar amounts displayed are not guaranteed, and what you actually pay may be different. These estimates are for educational purposes only.

Check out these worksheets we've created for you to plan for the next big step on the road to your new home! Discover your ideal neighborhood, fill out your dream home checklist, and put together all the documents you'll need to buy a home.

Great question! Your financial situation is unique, depends on several factors, and deserves its own custom analysis. Ruoff Mortgage offers a free, no-obligation pre-approval process, so you can find out how much home you can qualify for.

Ruoff offers a variety of different loan programs to fit each and every one of our clients’ needs. Depending on your location, income and ultimate goal you may qualify for a VA, USDA or other down payment assistance program. Each program allows you to purchase a home with no money down and each have different benefits.

Ruoff requires a minimum credit score of 580 for an FHA loan, other loans require a minimum of 620.

Closings costs are all the costs associated with getting a loan processed and completed (i.e. origination, appraisal, title, taxes, insurance, etc.). This amount varies depending on your loan type, personal situation and purchase agreement, and can be as little as $0. We will disclose an itemized list of closing costs prior to the day you'll close on your home. You can negotiate with the seller in your purchase offer to pay your closing costs. This is commonly called "seller's concessions".

Your monthly mortgage payment covers both your principal and the interest. Amortization refers to the method of repayment in which you pay more interest at the start of your loan than you do at the end. For instance, your first mortgage payment may apply 75% to the interest and 25% to the principal. Over time, the ratio will change until you are putting less than 5% of your payment towards the interest and the rest towards the principal.

It is considered a Buyer's Market when there are many more homes for sale than there are people looking to buy homes. Homebuyers have the upper hand.

A mortgage refers the legal agreement between a bank or non-bank lender and borrower to lend money in order for the borrower to purchase a property. Borrowers repay this debt over a long period of time, usually 30 years.

A pre-approval allows your mortgage lender to provide you with documentation on your financial status as well as the estimated amount of money you will be able to borrow. Your lender can then provide you with a pre-approval letter which will speed up the loan process once you're ready to purchase a property.

Underwriting is the process in which underwriters review the pending loan, borrowers, and property to ensure that the loan is a secure investment for the lender and the borrower. Underwriters protect both the lender and the borrower by making sure the mortgage loan amount matches the property's appraised value.

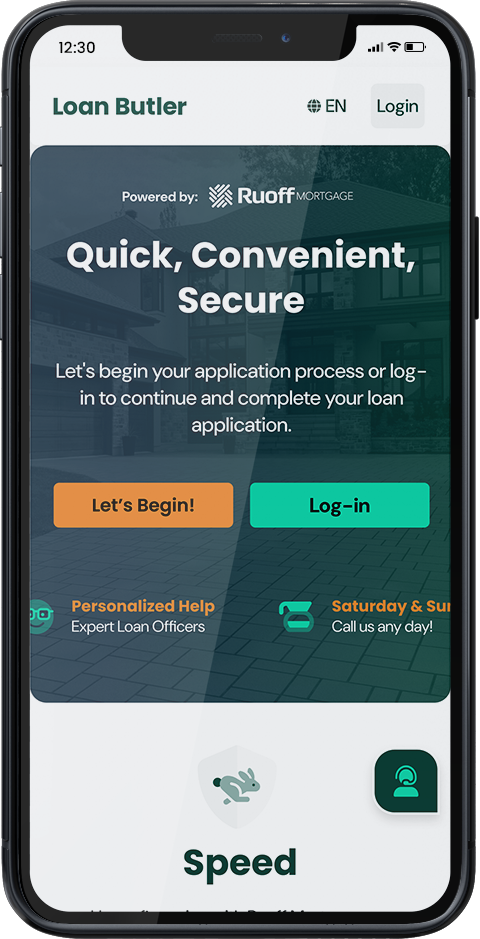

The Loan Butler App was created to provide you with a fast and convenient user experience with Ruoff Mortgage. Get the freedom and the power to move your mortgage process along at a rapid pace! The App can easily provide loan information and status including sending push notification reminders in real time when an important milestone is reached (underwriting approval, clear to close, etc.). The app allows consumers the ability to secure loan documentation and allows all parties on the transaction to keep track of the loan's progress.